The 4 Levels of Financial Leadership

In our last post, we challenged the idea that financial literacy is the finish line. Knowing about money is just the start; true mastery comes from actively leading your money.

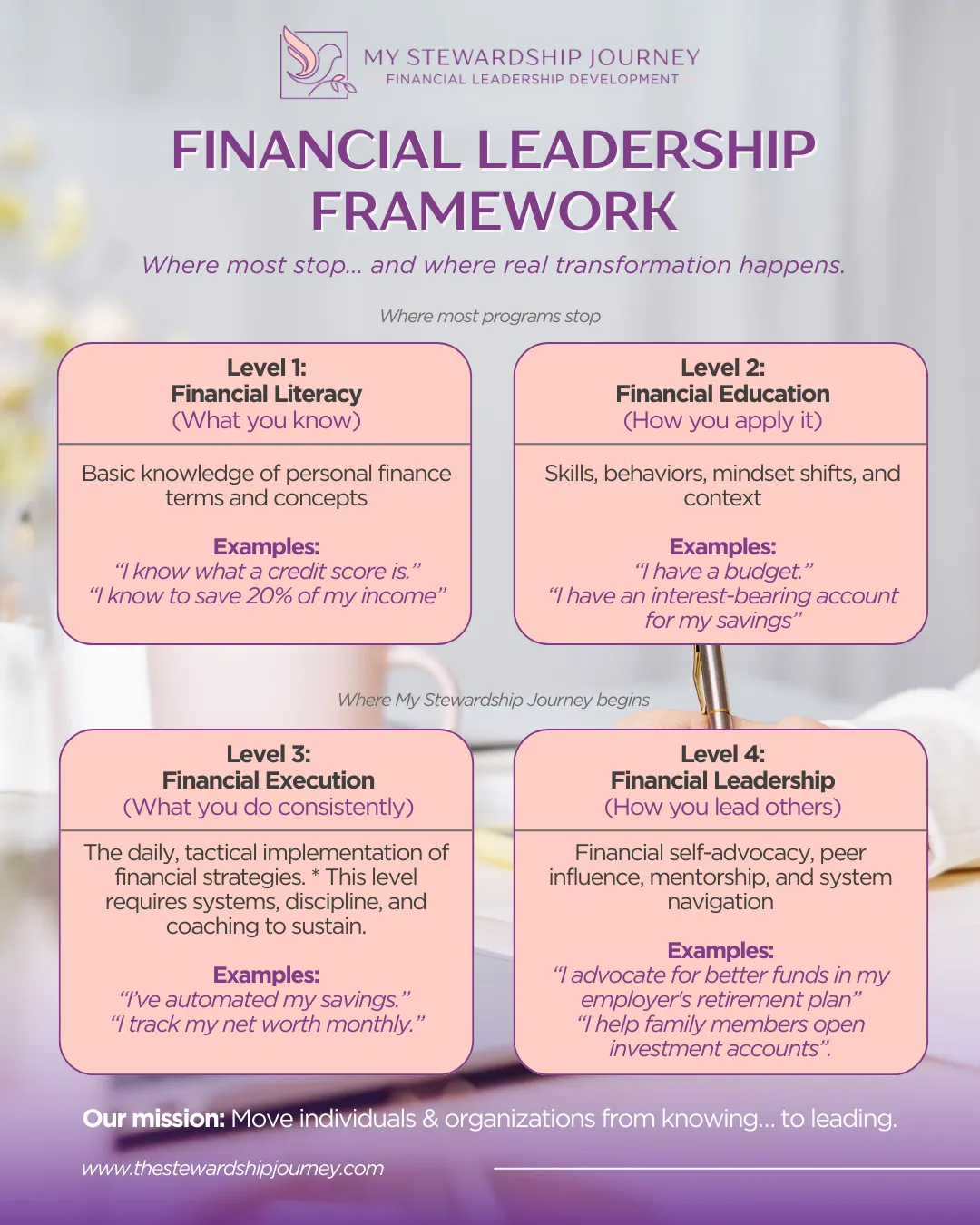

Today, I want to pull back the curtain and show you the philosophical framework that guides everything we do at My Stewardship Journey. It’s the roadmap we use to move you from simply knowing to actively leading.

Most programs stop at the first two levels, leaving you with knowledge but no consistent action. We are committed to helping you master all four levels of the Financial Leadership journey.

Our Financial Leadership Framework

Our framework illustrates the necessary progression from basic understanding to becoming a financial leader who can influence not just your own life, but the systems around you.

Level 1: Financial Literacy (What You Know)

This is the foundation. It’s the basic knowledge of personal finance terms and concepts.

Goal: Understanding the language of money.

Examples: Knowing what a credit score is; knowing to save 20% of your income.

Level 2: Financial Education (How You Apply It)

This is where you begin to translate knowledge into specific tools and mindsets. It involves skills, behaviors, mindset shifts, and context.

Goal: Creating a plan.

Examples: "I have a budget"; "I have an interest-bearing account for my savings."

Level 3: Financial Execution (What You Do Consistently)

This is the critical stage where theory meets reality. This is where My Stewardship Journey truly begins. Execution requires daily, tactical implementation, systems, discipline, and coaching to sustain it.

Goal: Systematically following through and automating your plan.

Examples: "I’ve automated my savings"; "I track my net worth monthly."

Level 4: Financial Leadership (How You Lead Others)

The ultimate level of system mastery. You move beyond your personal finances to exercise influence. This involves financial self-advocacy, peer influence, and system navigation.

Goal: Advocating for yourself and helping others build wealth.

Examples: "I advocate for better funds in my employer’s retirement plan"; "I help family members open investment accounts."

Ready to Level Up Your Leadership?

The distance between Level 2 and Level 3 is where most people get stuck. They have a budget (Education) but can't consistently stick to it (Execution).

At My Stewardship Journey, our programs are designed to install the systems, accountability, and disciplined routines required to master Execution and achieve Leadership. We’re here to help you bridge that gap.

For Individuals on the Path:

We invite you to take our Financial Leadership Assessment. This powerful tool will help you pinpoint exactly where your self-leadership skills are strongest and where you can focus your energy for the biggest impact.

For Organizational/Community Leaders:

Are you seeking to empower your staff or community members? Download our Financial Wellness Program Checklist to understand the key components of a high-impact financial leadership development program.

If you’re ready to move from knowing to leading your financial life, stick around. We’ll be sharing monthly insights and actionable tips to help you climb this ladder.

If you know someone ready to move past literacy and into leadership, please forward this post!

Facebook

Instagram

LinkedIn

Youtube

TikTok